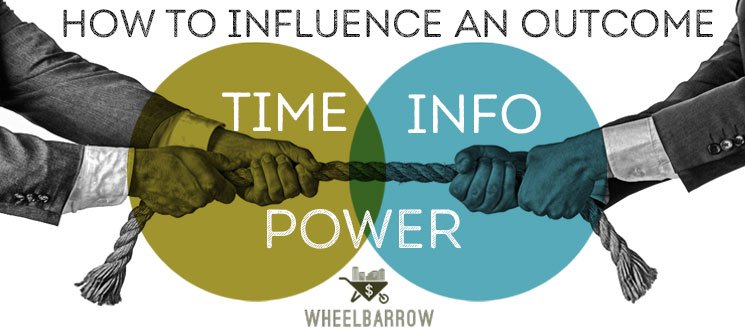

How to Negotiate Your Next Multifamily Deal: Mastering the SPY Technique

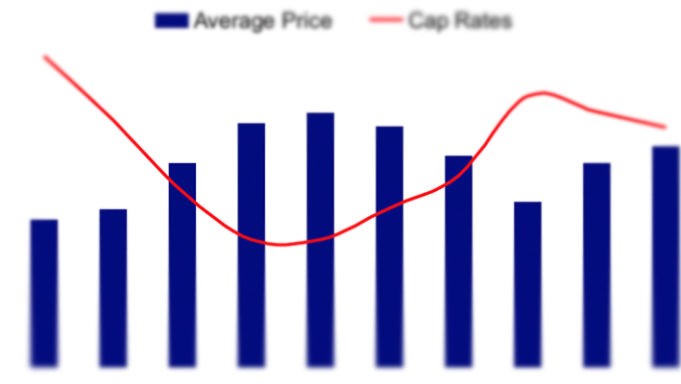

This article dives into the world of multifamily real estate negotiation, offering insights and strategies to close your next deal on favorable terms. The Importance of Negotiation The ability to negotiate effectively is crucial in any business venture, and real estate is no exception. It’s not just about getting the lowest price; it’s about understanding […]