7 Biggest Learning Lessons From Investing In Our First Rental Property

By Greg And Rachel Schwartz, Jake and Gino Members since 2019

We’ve learned a lot since jumping into real estate full time. After 9 months my wife, Rachel, and I both work full time in real estate while house hacking a 4 plex. This lifestyle transition was not easy, but nothing in life worth doing is. The journey began 3 years ago when I started learning about real estate and personal finance. We saved and learned, and learned and saved. In October 2019 I made the decision to transition from my position as a helicopter pilot in the Marines to my new career as a real estate investor and agent. We joined the Jake & Gino community to immerse ourselves in the education and surround ourselves with like-minded investors.

We chose to settle in College Station, TX and invest in our own backyard, literally. One day while driving neighborhoods, we came across a gentleman who appeared to be working on a 4 plex as part of a make-ready. Long story short, he was the owner and we made an offer the next day. Initially, our offer was rejected, but when the other offer fell through, we were ready and willing to step up.

Around this same time period, I got my real estate license. By sharing my knowledge of multifamily investing, I earned a reputation as a well-educated and determined new agent, which led to an offer to join one of the top-grossing real estate teams in the city. So by day, I have learned how to be an effective agent and by night, I have learned, through a lot of hard work and experience, how to renovate a 1980’s property. Luckily Rachel had taken it upon herself to dive deep into the world of property management. She built up the systems needed to market, lease, and manage our new tenants. The whole experience has been so different than we had ever imagined it. Our 7 biggest take away from the last 6 months are outlined below…

- Starting small, but not too small.

We determined that multifamily is the path we want to take in order to achieve financial freedom. But we wanted to start from the ground up. By combining these two ideas, we decided to house hack a 4 plex. House hacking is a very forgiving way to learn in the school of hard knocks. Rental income from 2 units effectively covers our mortgage. Problems are only feet away and can be addressed immediately. By starting here, we have gained the confidence and know-how to expand our search to 16, 20, or more units. We learned, don’t think that you have to GO BIG OR GO HOME, you can start small but remember to have a plan to expand exponentially. As Gino always says, “Think big, but start small.” You just need to start!

Discover how apartments are the best investment vehicle to create wealth and generate passive income:

- Due Diligence has to be painstakingly detailed and assumptions will bite you in the butt.

Once our offer was accepted, we started the process of due diligence. One of the first things we learned was that the original guestimate of $7,000, provided by the seller, for siding, was well below the actual cost. On top of that, it became clear that the roof was on its last leg. The total actual estimate for both roof and siding came out to $23,000. This would have been the ideal time to renegotiate the original offer and ask for 16,000 off the asking or money at closing. We didn’t ask for either. Naturally, this greatly affected our rehab budget and cut into our cash on cash return.

- Inheriting tenants is a gamble, plan accordingly.

Having never screened tenants ourselves, we were ignorant to the poor quality of the application and lease being used by the seller. During our initial offer, the building had 2 of 4 units filled with paying tenants. By the time we closed we were down to 1 non-paying tenant. We then spent the next 5 months attempting to reestablish a relationship with this tenant, ultimately ending in a 30-day notice to vacate. In hindsight, we would have planned and budgeted for this turnover and removed this problem tenant earlier in the process.

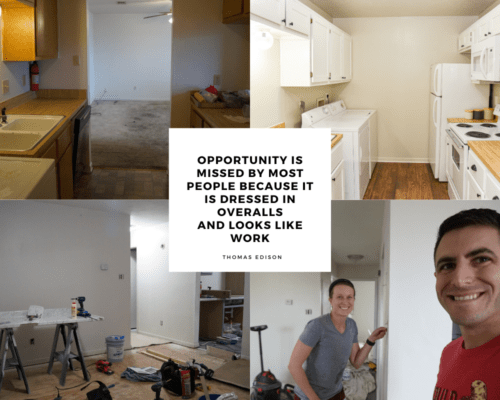

- Over rehab is a real thing.

We knew that a mild rehab for a unit should be in the 5-7k range. So we set aside 20k for the 3 units. But when the dust settled on the first 2 rehabs, and we crunched the numbers, we realized we spent closer to 8.5k per unit!!! Budgeting for the small things can be very difficult if it’s your first time. Things like caulk, trim, plumbing, paint rollers, and bug bombs add up quickly. When we were forced to stay within a strict budget of 3k, because we already spent most of the money, we leaned on the motto of “better than it was” and ended up with a great product for well under 2k. Those 8.5k rehabs rent out for $800 per month and the 2k rehab is set to rent for $775 per month. We feel that had we stayed strict to a 5-6k per unit rehab we would have all 3 units renting at $800 with great tenants.

- Exit strategy. Start with the end in mind and again…don’t assume anything.

Don’t assume anything. In our case, we assumed we could cash out refinance 100% LTV with a VA loan after 6 months. Wrong, wrong, and wrong. We now know that Texas restricts cash-out refi’s on a primary residence to no more than 80% LTV. From here on out we will sit down with a lender and discuss the refinance products that will be available to us.

- Set up systems now to support where you’re going, not where you’re at.

Even though we’re a small 4 unit operation, we’re implementing systems and using the software as if we’re a 150 unit complex. This includes an operations manual that is a one-stop-shop for every step from leasing to move out. Buildium, a property management software company, has been a key component of our organization and professional presence.

- Rely on the experience around you.

I learned this one years ago as a young pilot. As a know-it-all young man, I would proudly brief my creative solution to the simulated mission only to have my glorious plan fall apart in execution. Without experience I didn’t know what I didn’t know, and therefore couldn’t account for every factor. The solution to this is to bounce ideas of those with more practice. This is where the Jake and Gino community has been clutch. By surrounding ourselves with like-minded individuals, many of whom are more experienced, we were able to avoid catastrophic loss. An added benefit of this community is the decimation of limiting beliefs. Think it can’t be done… look around you, it has been done countless times by Jake & Gino students!

If you have any questions about our current project, or any new opportunities, you can email me at schwartz.gregory.m@gmail.com.

You can also find us on BiggerPockets and LinkedIn.