How To Flip A Small Apartment Complex

When Jake and I bought our first apartment, our investing strategy was solely focused on buy and hold forever. We were still new investors in the space, and we had yet to create our three-step framework Buy Right Manage Right & Finance Right™. In this article, I will go into detail how and why we became more flexible as investors, why we added another tool in our tool belt and began to flip certain multifamily properties we own, the reasons we would flip a multifamily property, and share a case study of one of our most recent flips of an eighteen unit apartment that netted OVER $600,000 in profit.

In my former career, I owned a small restaurant and Jake was a pharmaceutical rep. Do you know how many pizzas I have to sell to net $600,000? I could feed an army with all those pies!! And Jake would have to visit hundreds and hundreds of doctor’s office to yield those results.

Yet, when we bought that first deal, we were hell bent on buying and holding onto deals long term. Our focus was solely on buying great deals that would cash flow for us, so that we could quit our day jobs and go into real estate full-time. At Jake & Gino, we like to say “If it don’t cash flow, then let the grass grow!” Cash flow, to us, is the lifeblood of real estate. It has allowed us to exit our jobs, and having a stable part of your portfolio with cash flowing assets is our goal, but you will have to manage that cash flow.

We were able to refinance the majority of our assets and repurpose the proceeds into the next deal quite successfully, without overleveraging the assets and maintaining the cash flow. But, as we progressed deeper into the market cycle, asset prices began to skyrocket, and refinancing these assets did not make sense. By following our three-step framework, we were buying these assets at a discount, repositioning them, and driving up valuations. It became apparent to us the best strategy was to sell some assets and find another assets to purchase at a discount.

I would like to make a sports analogy that is relevant to real estate. In football, it is said that sometimes you need to take what the defense gives you. In real estate, you have to take what the market gives you. If you are in a buyer’s market, the strategy is to buy as much real estate as possible and ride it up the cycle. In a seller’s market, it may be time to take some profits off the table, and build up your reserves. That is exactly what we did with an eighteen-unit complex that we just flipped.

Let me set the stage with the purchase of this asset. We purchased this asset from back in December of 2018, a one hundred and forty six unit scattered site deal that consisted of several different properties. We purchased it at $27,000 per unit due to several factors:

- Forty-six units were vacant, abandoned or non-paying. We call that a hairy deal in multifamily, and a deal I would never recommend to newer investors. For those of you keeping track, vacancy was at around 70%.

- Drug problems and criminal activity were rampant.

- Deferred maintenance was large, especially the interior units.

- The majority of the units were one beds.

We needed to use our community bank to finance the deal due to the underlying problems, and we received an 80% loan to cost financing for the deal. The community bank was willing to finance 80% of the rehab. It pays to have a great relationship with a local lender.

Two days after we closed on the deal, a news station showed up at one of the properties interviewing a resident who was living in a mold infested, dilapidated unit. Fortunately for us, our property management team was up for the task. They were already addressing the major issues in the unit, and we were able to avoid negative publicity and deliver an updated unit to the resident.

The reposition has taken much longer for a couple of reasons. The problems on the property, such as crime and deferred maintenance, caused delays and work to take much longer than normal. On top of that, our repair crew was stretched thin due to having to finish other projects. After two years, the majority of the units have been turned, and the asset can be considered stabilized.

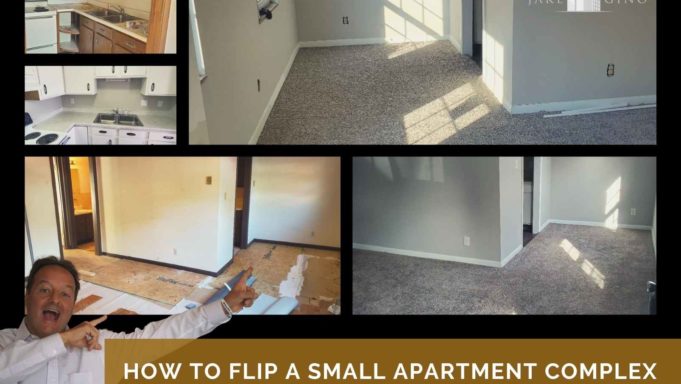

Let’s analyze the improvements to the eighteen-unit property. Here are some key metrics:

- Eighteen one-bedroom units.

- Six hundred fifty square feet.

- Price per unit of $27,000.

- Rents at purchase: from $400 to $550. Some units were receiving rental assistance.

- Rents when sold: $625, with rents continuing to escalate.

Here are the costs and timetable associated with turning this property:

Cost per turn:

- $3,000 per unit broker down into:

- Flooring

- Painting

- Sub floor repairs

- Fixtures

- Replacement of all PTAC (Packaged Thermal Air Conditioner) Units. We negotiated a price of $500 for each due to bulk purchase

- .Exterior work:

- Total of $3,000 broken down into:

- Power washing

- Exterior shutters

- Sealing parking lot

- Painting breezeways

With this property, we inherited several challenges. The exterior of the property was in good shape, evidenced by the small budget that we spent. The interiors were all in need of a rehab, and the property was known as a high crime area. The market was good, but the property itself was a problem. We knew that if we could take control of the resident base, we would be able to attract a higher quality resident.

It is much more challenging to lease to individuals in these areas, along with hiring staff that is willing to work in this type of environment. This whole rehab took eighteen month due to these factors, along with turning six other properties. Once the rehab was complete, we witnessed the transformation of another Jake & Gino community.

Normally, at this point, we would consider refinancing this property. Unfortunately, this eighteen units was a small part of a larger portfolio, and our decision was to sell it and recoup some of our initial investment. We were not excited about how this property was constructed, how the units contained PTACs and not central A/C, so we explored the option of selling this individual property.

Fortunately for us, our community banker would allow us to “peel” off these eighteen units from the portfolio, and retire the debt that was connected to the deal. We knew that we were in a seller’s market, but weren’t ready for the high valuation that was placed on it by the brokers.

We brought the deal to market at $1,260,000 ($70,000 per unit), and a few weeks later we received an offer of $1,206,000, ($67,000 per unit) where we ended up closing sixty days later. After commissions and rehab costs, we were able to net $600,000. Being flexible in your business plan and following our three-step framework can yield some amazing results.

So the next time you think to yourself “It’s only a small deal. Why waste my time?” Think of how many pizzas it would have taken Gino to make in order to net $600,000. I want you all to seriously consider adding the flipping apartment strategy into your investing toolbox! And be sure to implement the three-step framework along the way to your next flip.

Here are my learning lessons on this lucrative flip:

- Create your exit strategy based on the market cycle. Valuations are high, so taking some money off the table to repurpose on another deal made sense to us.

- As Jake likes to say, don’t poo-poo a small deal. They can be extremely profitable from a buy and hold or flipping strategy.

- This deal reaffirms to me our sentiment of “Think big, start small.” It doesn’t matter the size of your first deal. What matters is closing your first deal, and then momentum will take over.

- Selling may be a better option in certain deals than refinancing. We are going to refi & roll the remaining units, but if you are in the part of the cycle where it is more difficult to refi & roll, then selling is a viable option.

- Buy value add deals in desirable neighborhoods, where you can attract quality tenants.

- Focus not only on the value-add component, but also the operations component. We drove operations by driving revenue and decreasing expenses.

- Try not to bite off more than you can chew. This project took much longer because we had other capital intensive projects. We set an unrealistic expectation of twelve months, when in reality, it took almost double.

- When you do bite off more than you can chew, figure it out and MIH!!

- Multifamily is not a pie in the sky. Anyone can purchase their first deal and start building cash flow and wealth.

As I mentioned previously, flipping an apartment is only one strategy that we have employed with success in the multifamily space. If you want to learn more on how to flip your next apartment, reach out to one of our team members by clicking here: Jake & Gino.

Now, it’s time to go out and find your next deal!