The Fountainhead of Investing: Impact of COVID-19 on CRE

By Will Coleman

The Impact of COVID-19.

It is no doubt that we are all witnessing history. While the long-term impact of COVID-19 as of today cannot be fully understood it is certain that we are in the middle of an economic global shut down arguably never before seen in human history. How long will it last? What will be the effect on commercial real estate? The hospitality industry? Travel? The workplace? While we are still in the wait and see phase of this stranglehold, one thing stays true, the fundamentals. Buy Right, Finance Right, Manage Right.

It is no doubt that we are all witnessing history. While the long-term impact of COVID-19 as of today cannot be fully understood it is certain that we are in the middle of an economic global shut down arguably never before seen in human history. How long will it last? What will be the effect on commercial real estate? The hospitality industry? Travel? The workplace? While we are still in the wait and see phase of this stranglehold, one thing stays true, the fundamentals. Buy Right, Finance Right, Manage Right.

The Numbers so Far.

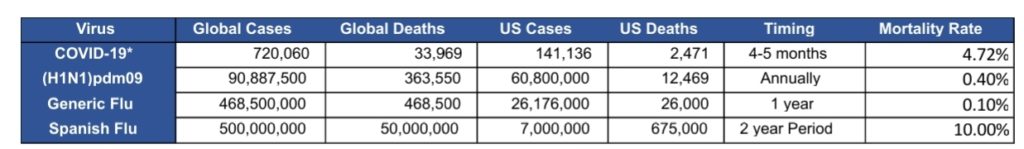

While the comparison of COVID-19 to other global pandemics is still a bit too early to be considered valid, we wanted to create a chart that put together the best summary of the major viruses in discussion as of late. This is something we will be keeping an eye on in order to better understand the danger of COVID-19. *COVID-19 #’s as of 3/30/20

*COVID-19 #’s as of 3/30/20

Sources: Reuters.com & CDC.gov

Select numbers are based on the average of ranges given by the CDC and scientific models estimating total cases & mortality rates.

The numbers for the Spanish Flu vary widely, the mortality rate could be +/- 3% or 4%.

Since 3/25/20 the COVID-19 cases have increased by the following percentages:

- Global Cases: 71% (From 420,997 to 720,060)

- Global Deaths: 80% (From 18,837 to 33,969)

- US Cases: 166% (From 53,018 to 141,136)

- US Deaths: 247% (From 713 to 2,471)

The total cases of COVID-19 to date are still low compared to other major pandemics however, the number of deaths and speed of which these numbers are increasing is starting to shine light on this virus’ danger. The mortality rate and the level of contagiousness are the main worries so far for COVID-19; most experts expect the mortality rate to drop considerably once more cases are confirmed. The R-Naught value of COVID-19, which is the mathematical term that indicates how contagious an infectious disease, is estimated to be 2-2.5 according to the World Health Organization. Relative to other pandemic’s the R-Naught for H1N1 was 1.46, the generic Flu at 1.3, and the Spanish Flu at 1.8.

How does this impact the economy? CNBC stated, “JPMorgan on Wednesday estimated the first-quarter gross domestic product would contract at a 4.0% annualized rate followed by an even steeper 14.0% decline in the second quarter.” While the true impact COVID-19 will have on the labor market is difficult to predict “we have already seen the initial claims for state unemployment benefits jump 70,000 to a seasonally adjusted 281,000 for the week ended March 14, the highest level since September 2017, as stated by the Labor Department”. The worst month for job losses during the financial crisis was 800,000. While the predictions for job losses in April 2020 vary widely this will certainly be a metric to keep an eye on.

An article posted by Reuters predicts that the unemployment rate will increase from 3.5% to 5.3% which would equate to approximately 3 million job losses. However, The US Travel Association stated that the virus could eliminate 4.6 million travel related jobs this year and the National Restaurant Association lobbying group predicts the industry could lose 5 to 7 million jobs over the next 3 months. Keep in mind these potential job losses stated by the US Travel Association and the National Restaurant Association seem to be the worst-case scenario and don’t factor in government stimulus. Most experts are predicting an unemployment rate of 9-11%, and many are starting to say it will be worse than that. While these numbers are only projections, we can easily see that there will be a sharp increase in unemployment in the coming months.

Based on these numbers we can expect serious turmoil to the economic system as we continue to wait and see how much the total number of cases will grow and the level of effectiveness the government’s stimulus package will have. Ultimately the question is, when will people feel comfortable going back to work, to travel, and to go shopping? While we have no choice now but to stay calm and collect more information, we must prepare for how this impacts our business.

Green Street Advisors released research which estimates the property value declines in different sectors of Commercial Real Estate. See a few of the percentages below:

- Senior Housing: -49%

- Student Housing: -30%

- Malls: -29%

- Manufactured Homes: -28%

- Apartments: -23%

- Single Family Rentals: -19%

- Self-Storage: -16%

While these are only projections, understanding the impact COVID-19 will have on different sectors of the real estate industry is important when calculating the risks and returns for your current and future investments.

How Do We Protect Ourselves for the Future?

Every crisis presents opportunities. As investors the opportunity we have right now is to learn from the mistakes that may have put our investments at risk due to the COVID-19 pandemic. The answer is the fundamentals. Buy Right, Finance Right, Manage Right. By basing our investments on these principles, we feel confident in our ability to weather the storm and ultimately thrive during the recovery.

Buy Right – Understand Your Market and Its Numbers.

Before you buy you must understand your market. What are the population trends over the last 5-10 years? What is the cause behind those trends? What is the job diversity? Who are the major employers? What is the longevity of those employers over the life cycle of your investments? What sub-markets should you avoid? By having a strong understanding of your market, you can confidently identify the supply and demand for apartments over the next 5-10 years and how heavily they will be impacted by a downturn.

By understanding the fundamentals of your market, you will also better understand the numbers behind asset values when making offers. You need to know your market’s occupancy rates, cap rates, rental rates, operating expenses, and how these metrics have changed over time. You can use these metrics to create your parameters as to what you consider a good or bad deal in that specific market. By buying at the right price and not overpaying you can mitigate against value declines because you bought on fundamentals not future optimism.

Finance Right – Your Leverage Should Help You Not Hurt You.

Leverage is a tool that if used correctly can be the most effective way to increase your overall returns. However, if leverage is used incorrectly it can pin you in a corner and force you to foreclose on your asset. The fundamentals when considering financing are simple. One, don’t over leverage because you think asset values will continue to go up; there will undoubtedly be times when they won’t. From a historical context 70-75% LTV is considered a good leverage level for commercial real estate with select exceptions.

Two, correlate your financing with your business plan from start to finish. Make sure you and your banker understand your business plan during the purchase, operations, and exit to make sure that the financing assists your ability to execute.

And third, factor in where you are at in the market cycle when applying for financing. This links with the idea of don’t over leverage but the appetite of banks will change and what people consider “over leveraged” will change over time, for instance in the 1990s it was possible to get 100% LTV loans. So, if we ever do get into an environment where more and more borrowers are going after 80-85% LTV loans don’t feel pressured to follow suit unless you feel very confident in your ability to execute.

Manage Right – Be an Operator.

By the time management comes into play, your purchase price and financing terms are fixed and therefore out of your control. What you can control is the management and operations of your property. Whether you choose to self-manage the property or hire a third-party management company it is vital to understand the operations from a numbers and personnel point of view. Interview multiple property managers in the market you have chosen and ask them about the rental rates they are seeing, the operating expenses, crime rates, and how their process works.

By the time management comes into play, your purchase price and financing terms are fixed and therefore out of your control. What you can control is the management and operations of your property. Whether you choose to self-manage the property or hire a third-party management company it is vital to understand the operations from a numbers and personnel point of view. Interview multiple property managers in the market you have chosen and ask them about the rental rates they are seeing, the operating expenses, crime rates, and how their process works.

We highly recommend being on weekly calls with your property management team in order to keep the lines of communication open. By being an expert and having control over your operations you will be better prepared during a downturn which will help you mitigate against overall risk.

Here we can execute a high level of control due to our property management being in house. We are doing things like emergency only spending, delaying unit turns, holding back draws and owner payments, closing the leasing office to the public, and providing a high level of communication to our residents. Additionally, maintaining significant amounts of liquidity is essential to protecting yourself against a downturn.

Where Do We Go from Here?

While the short-term and long-term impact of COVID-19 is still unknown there is no doubt it is an unprecedented event that has the potential to do real damage to the global economy. However, we cannot react in fear and must face this pandemic with courage and resolve. As the impact unfolds it will only validate the importance of investing based on fundamentals. While the real estate market will be hurt, it is based on one of the strongest fundamental needs in human history, shelter. Residential real estate will recover and will always be one of the best industries suited to withstand an economic downturn if the buyer adheres to the industry’s fundamentals.

If you have any questions about investing with us of refinancing your next deal with us check us out at CRE. Thanks for reading.

Will Coleman, Director of Finance

Mike Taravella, Asset Manager

Connect with us via Social:

Facebook – http://bit.ly/39EL2YT

Instagram – http://bit.ly/3aGLfuE

LinkedIn – http://bit.ly/2xpq0zh

YouTube – http://bit.ly/38BkJ4z