How To Perform Jake & Gino’s Three-Step Due Diligence On A Multifamily Property

How To Perform Jake & Gino’s Three-Step Due Diligence On A Multifamily Property

Any experienced investor will tell you how significant it is to know how to conduct a thorough multifamily apartment due diligence. Due diligence is defined by Investopedia as the care a reasonable person should take before entering into an agreement or a transaction to another party. I learned the importance of due diligence, or lack there of, soon after my first real estate blunder.

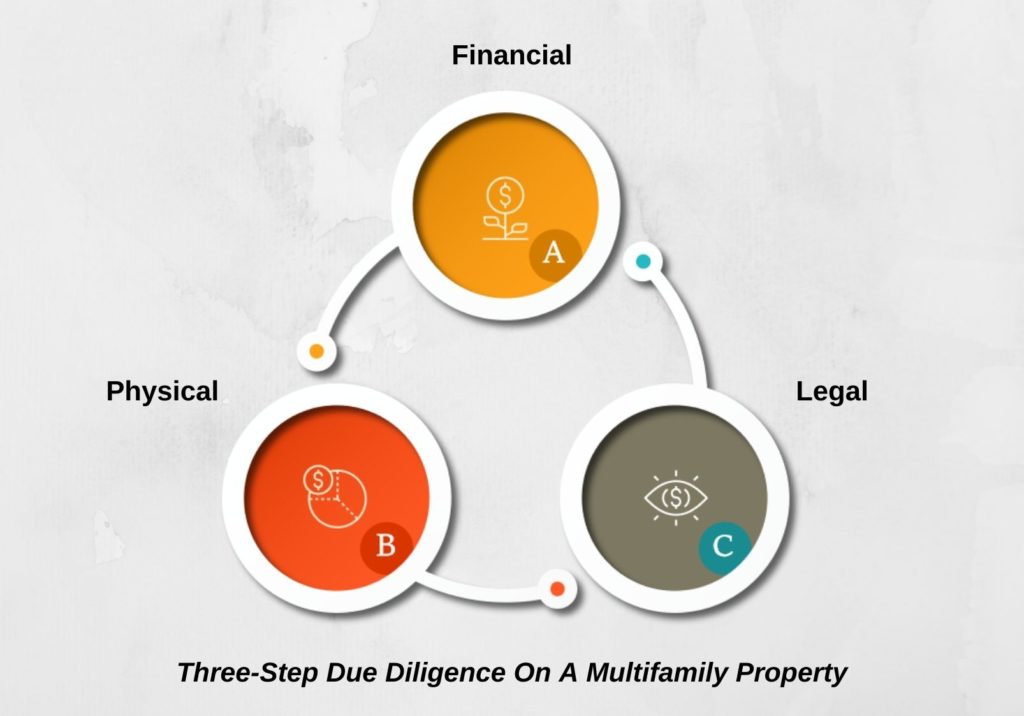

There are 3 types of due diligence:

- Financial

- Physical

- Legal

As a rule of thumb, always perform the financial due diligence first. If the numbers don’t work out, then you didn’t waste any money or time on the property inspection or legal work. The majority of deals that don’t go to closing are because of the financial due diligence. In these uncertain times, we recommend a thirty day due diligence period for performing your due diligence. The due diligence period should not commence until you’ve received ALL the requested financial documents. This will motivate the seller to turn over all the records in a timely fashion so you can perform an accurate analysis of the property’s performance much more quickly.

Let me recap the three types of due diligence:

Financial

It’s all about the numbers. Analyze a property based on actual numbers. Request the last twelve months of profit and loss and calculate the net operating income based on this statement. Once the numbers hit your investing criteria, move onto the next step.

Physical

Once the numbers work, it’s time to inspect the property. If you don’t have an inspector, visit home inspector to find a professional in your market. Be sure to inspect every unit, and negotiate the price with your inspector. You can expect to pay around 500 for a small multifamily property, and a per-unit cost for a larger multifamily property.

Whatever deficiencies you find with the property can be negotiated with the seller. Don’t be cheap!! Inspect every purchase.

Legal

When you purchase a property, you want the property to have no encumbrances, or liens, to have good title, and to have a valid certificate of occupancy (C of O). Your title company will provide title insurance to protect you if there is ever any question to the title of the property. Check to see if the property has any type of liens, and have the seller “cure” the liens before you take over.

As far as the C. of O, I have been a culprit of this mistake. I once purchased a four family that was zoned as a three family. The attorney and the bank did not pick up on this mistake, and after holding the property for several years, we went to refinance the property, and it ended up taking years and thousands of dollars to bring it up to code. Oh, the pain of that lesson!

Here is a step by step approach to analyzing and purchasing real estate correctly

- Verify income.

- Verify expenses.

- Calculate net operating income.

- If property meets your criteria, then proceed to the letter of intent. If not, then start the process over and continue your search for other properties.

- Draft Letter of Intent.

- Agree on a price.

- Fill out Purchase and Sale agreement.

- Perform due diligence.

Here is a list of a few problems that can occur during the due diligence phase:

- Repair costs/larger capital improvement.

- Poor tenancy with low security deposits.

- Leases don’t match lease schedule.

- Run out of time.

- Property owner not cooperative.

All of these problems can be addressed with the seller. If you turn up unseen repairs, such as replacing a roof, or a damaged foundation, you can go back to the seller and ask for a price concession to fix the damage. In real estate, investors refer to these price concessions as “re-trading”. One does not want to be labeled as a re-trader because most brokers will be unwilling to work with you if you constantly want to lower the price once you have gone to contract.

Once you sign the contract, most brokers have already spent the commission. Can you imagine their anger if you jeopardize the deal and threaten not to close? Only consider re-trading when there are legitimate repairs that were uncovered during the inspection phase. If you are asking for the seller for a concession to cut down a few trees, that is not a fair re-trade. You would have seen those trees during your due diligence phase.

If the leases do not match the schedule, then you can either have the owner produce the leases or adjust the income according to what the leases show. If the property contains poor tenancy, then this should be reflected in the price with lower occupancy figures and lower rent collections. As an investor, my number one rule is to buy a property on actual numbers. So go back to the seller if there are any discrepancies in either the income or the expense figure, and reduce the price accordingly.

During these challenging times, economic occupancy can at times be much lower than physical occupancy. You need to ask yourself is there enough value on this property to take in the risk of purchasing an asset with lower collections. And you need to ask your bank of they will finance the asset with lower collections.

If you run out of time, you may be at risk of losing your down payment. We always ask for an extension of time to perform and close on the deal. It is a bit more difficult to deal with an uncooperative seller. Some sellers are a pain in the butt, and some are just simply disorganized. Have patience in both situations and keep your eye on the prize.

Some investors “go hard” from day one, meaning that their down payment is non-refundable, whether they close on the deal or not. Some markets are so competitive that buyers utilize this strategy to compete to win deals. We have yet to employ this strategy, and I recommend you think twice before allowing your down payment to go hard from day one, because you do lose leverage in the due diligence phase. Some investors simply perform their due diligence before entering in the contract, hoping that something unexpected does not show up.

Task:

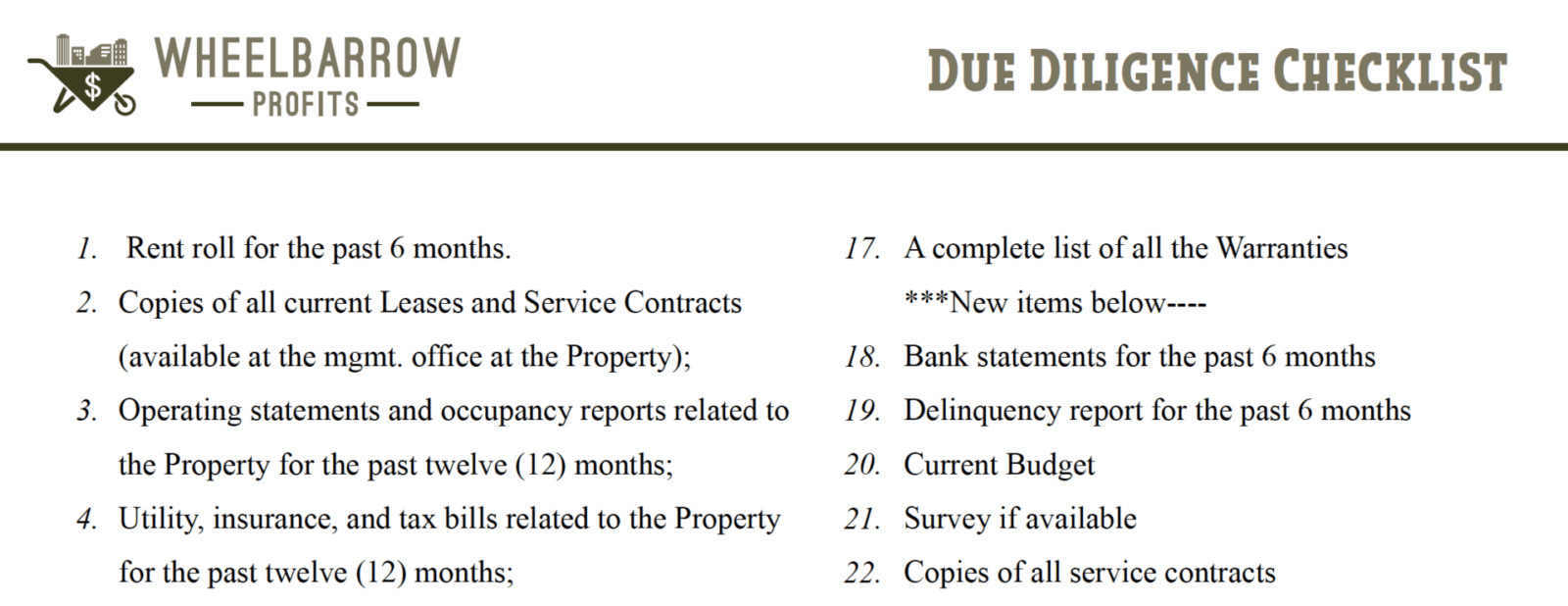

Download our Due Diligence Checklist to perform due diligence on your next deal: Due Diligence Checklist

I am always curious as to what problems you have run into during your due diligence period. Please leave a comment below and we will compare battle scars. Bet you mine are bigger than yours.

Become a true master at analyzing and identifying profitable multifamily deals both quickly and accurately. Click on the below image to check out Jake & Gino Deal Analyzer now!