Property Classification Rule of Thumb

In our previous article, we focused on unit mix and the importance of choosing an apartment complex with the most beneficial unit mix. In this article, we are going to focus on property classifications. Property classifications are important because the investor will know what type of return to expect with the property and the investor will be able to convey to brokers the type of properties he is targeting. It is imperative that an investor become intimately familiar with cash flows and cap rates associated with each class of property.

A-properties are the most recently constructed units, those that contain top amenities, require low maintenance, and are inhabited by young white-collar workers. These assets tend to be more stable, have less risk, and charge higher rents, all of which are the reasons they trade at lower cap rates.

This type of property will appreciate more, but cash flow will be harder to come by.

My view is that an A property is excellent for wealth management, and large institutions such as REITS focus on this asset class. If your objective is to create wealth, look elsewhere.

B-properties have typically been built within the last 20 years, and it usually has a mix of white-collar and blue-collar workers. The property will show its age by a bit of deferred maintenance or functional obsolescence. You may also see older heating and cooling systems, roofs that have a bit of wear and tear and parking lots that need repair.

B-properties have a good mix of appreciation as well as cash flow.

C-properties tend to be at least 30-years-old and contain mostly blue-collar workers and section 8 tenants. They contain a fair amount of deferred maintenance, and these properties are poised for cash flow. There’s less appreciation potential unless the investor repositions the property and improves operations.

This is our favorite type of property class to invest in because these tenants are less likely to purchase homes and will become long-term tenants if treated properly. Our broker in Knoxville refers to C properties as “crap” properties, but loves to invest in this type of asset because of ability to cash flow and reposition to a higher class. Investors are always on the lookout to buy a C property and reposition it to a B property.

D-properties the lowest class of property, are usually located in inner cities where it’s difficult to collect the rent and vacancy rates are high. These properties are highly management intensive and the tenant base is often difficult to deal with. Investors get lured into investing in these properties due to the low prices, but soon realize they got more than they bargained for.

Unless you can purchase a D-property and reposition it to become a C-property, you’re better off staying away from them.

To recap, here are a few rules of thumb for these property types: A properties will have the greatest appreciation, but the worst cash flow. Investors will buy these A assets because they tend to be less risky and therefore the return will be lower. The less risk the asset has, the lower the cap rate. B properties will have a good mix of cash flow, as well as appreciation. C properties have great cash flow, but appreciation is limited, unless forced.

A properties have the lowest cap rates, ranging from 3 to 5.

B properties are in the range of 6 to 9.

C properties hover in the 10 plus range

D properties start at 13, and can escalate from there.

Just remember, a 15 cap rate looks great on paper, but it means ZERO if you can’t collect the rent. The current market conditions and price escalation in the multifamily space have pushed cap rates down.

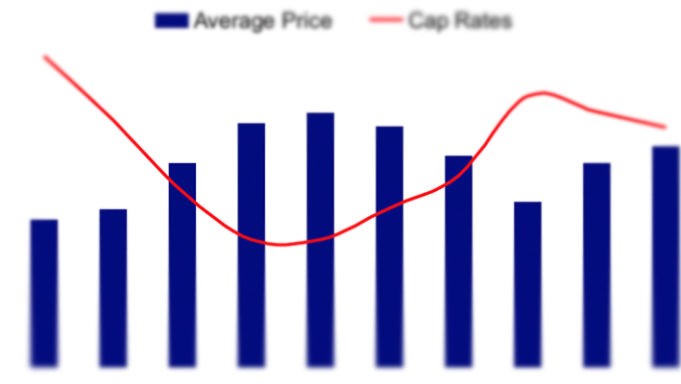

Cap rates have an inverse relationship with prices. Once prices increase, the expected rate of return of the asset contracts and thus the cap rate decreases. The flow of money into the multifamily investment has perpetuated the reduction in cap rates.

Task

Research the cap rates in your market, and choose an asset class to invest in. Analyze current deals based on actual numbers and present your offers to the brokers based on your calculations. Do not use pro forma numbers in your calculations.

One note: Cap rates are used primarily in multifamily investing, and are seldom used in Single Family Homes.

If you would like any more information on multifamily investing, please visit JakeandGino.com. Please leave us a comment below and let us know what type of property types you invest in.