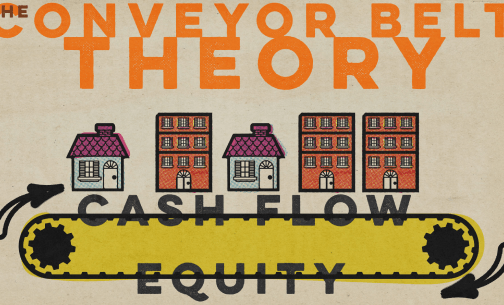

The Conveyor Belt Theory ™

The Conveyor Belt Theory of Real Estate is a concept to describe how a real estate portfolio is built over time. The beginning of the belt represents a closing. The end represents a liquidity event (sale or refinance). The concept shows us how wealth is built through cash flow, during the ownership of the asset and how capital gains are created by the appreciation of equity and paid at the liquidity event. If capital gains are reinvested (back to the front of the belt), wealth is created with each cycle. Read More…