What Are The Four Phases Of A Real Estate Market Cycle

How to Use The Four Market Phases To Buy Right

One of the biggest mistakes when I began investing in real estate was being unaware of the four market cycles in real estate, and a lack of understanding on how to invest in each part of the market cycle. In this article, I am going to discuss how you can avoid my blunder by discussing the Three Pillars of Real Estate®: Market Cycle, Debt, and Exit Strategy, and how to invest in multifamily utilizing the market cycle. I am also going to describe in detail all four parts of the market cycle.

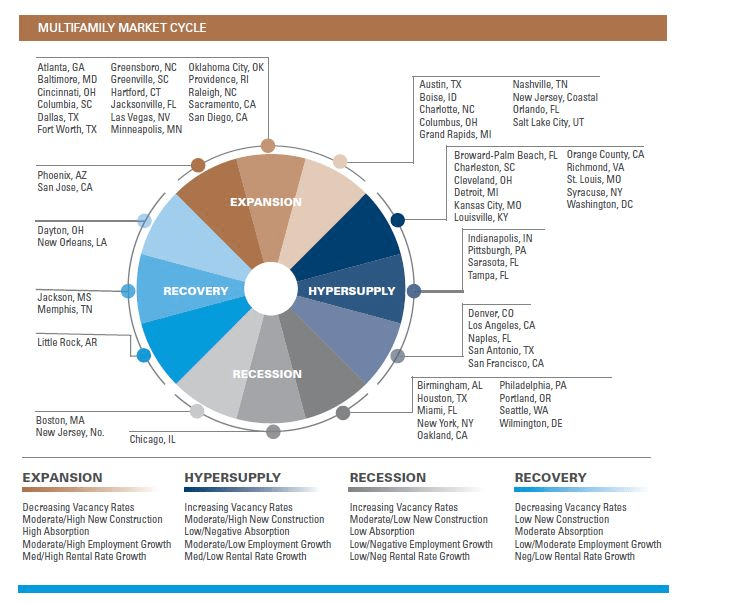

Let me begin by sharing a chart of the four phases of the market cycle that was created by Integra Realty Resources, (IRR) a company that provides world-class

commercial real estate market research, valuation, counseling, and consulting services. I would highly recommend visiting their website and downloading their resources.

As you can see from the chart, there are four phases of the market:

- Recession

- Recovery

- Expansion

- Hyper Supply

What you need to understand is that although most people look at real estate from a macro perspective, that is, from the entire United States, when it should, in fact, be looked at from a micro perspective. What do I mean by that? Real estate values and market cycles vary substantially from one market to the next, one city to the next, and even one neighborhood to the next. As you can see from the chart, Chicago IL is in a phase of recession, while Atlanta, GA. Is in a period of expansion. Once you realize this, you can adjust your investment strategy and underwriting criteria accordingly. You will also realize that Atlanta appears to be in a much stronger phase of the cycle, and thus demand for multifamily will be higher than Chicago.

Let’s describe each phase:

Phase 1: Recession

Anyone remember 2008? The vacancy rate was increasing and new completions were being delivered to the market. The new construction came to a halt, but it was too late. There were fewer renters due to job losses, while the addition of new inventory was continuing to come onboard. This led to the rapid decline of rental rates, as well as occupancy rates, and ultimately accelerated the downturn in real estate values. Cap rates began to decompress (rise), which leads to prices to drop.

No one can predict the next recession, although it appears we are close to one. By analyzing the chart above, some cities are already experiencing recessionary characteristics. It’s up to you to decide if you want to invest in those markets, or shift to another market. This is the part of the market cycle where you want to buy assets with significant value-add and reposition these assets. Back in 2009-2013, these assets were called distressed. Now, the marketers like using the term value-add. Different way of saying the same exact thing.

In this phase, debt is very hard to secure, but here is where you can find undervalued deals. Consumer and investor sentiment is low, but many a contrarian investor has made a killing in this part of the cycle. Creative financing techniques are very popular in this phase, and buying for the long term is a good idea to ride the wave of appreciation.

Phase 2: Recovery

The characteristics in this market phase include declining vacancy, and no new construction. In my opinion, this is where the savvy investor can explode his or her wealth by “buying right”. Unfortunately, securing financing during this phase can be difficult and sentiment is still very weak. The contrarian investor thrives in this phase as well, and legends such as Sam Zell, commonly referred to as the “Grave Dancer”, created an empire while competitors were running for the exits.

In this phase, you will have a mix of creative financing opportunities, in addition to utilizing community bank financing. We like to use community banks as a “bridge” to refinancing our deals to Fannie and Freddie. If the goal is to either flip or refi, focus on smaller prepayment penalties with your debt.

Phase 3: Expansion

The expansion phase is a fell good phase. It takes a few years for new inventory to come online, and during this period, rents and occupancy both expand. In 2019, rent growth was a healthy 2.9% and occupancy stood at around 96%. Cap rates are continuing to compress, which leads to prices of assets escalating. As the cycle deepens into the expansion phase, we tend to shy away from heavy value-add deals, and focus on deals that are newer and have less capital expenditures. One thing we have noticed in this phase is that cap rates for the different asset classes compress and get closed together. What do I mean? Traditionally, C properties (older, more deferred maintenance) trade for a 7-8 cap, while A properties (new, lots of amenities) trade for around a 4 cap. In the expansion phase, C properties cap rates drop into the 5-6 range, and the difference in cap rates shrinks. You are paying more for your value-add deals in this part of the market cycle.

As the market is accelerating, what are you going to do? If you plan on holding, now is the time to secure long term, low, fixed rate financing with Fannie & Freddie.

Phase 4: Hyper-Supply

Trouble is brewing on the horizon. Vacancy begins to increase and new construction is still ramping up. This is a period when builders need to recognize what is occurring and should put the brakes on new construction. The party is starting to come to an end, and a recession is right around the corner.

Deals are harder to come by in this phase, but we are still actively pursuing them. It’s all about the numbers, and we buy on ACTUAL numbers, analyzing the last twelve months of a property’s profit and loss statement. The goal is to be able to buy a property that has the potential to increase NOI without performing significant rehab. We like to utilize the strategy of creating value through operation, not renovation. We are looking for operational inefficiencies where we can either lower expenses or increase income through sound property management.

If you get a deal in this part of the cycle, you may want to secure long term, fixed rate financing so you don’t have any debt coming due during a down turn in the economy. You don’t lose money in real estate, unless you have to sell. The big losers in the last recession were the ones who had their debt come due, and could not refinance their debt. Falling prices, coupled with falling rents is not a recipe for a successful refinance. Most investors had to give back their properties to the bank. Those who road out the recession came out the other side even stronger.

Tasks:

Decide what market to invest in, and begin to research the market. Focus on job growth, which should average at least 2% growth for two consecutive years. To access data for jobs in a market, Google the name of the city and “job growth or utilize the website www.bls.gov to gather employment data for a specific city. Look for companies announcing a move to a market, and become familiar with employers in your market.

Target markets that are experiencing household and population growth. Household growth is a more powerful barometer because households are the ones that become our clients.

Finally, take action and educate yourself on the power of multifamily investing.

Check out our latest book that talks about ‘Real Estate Market Cycles’: https://amz.run/4IAF